Platform Introduction

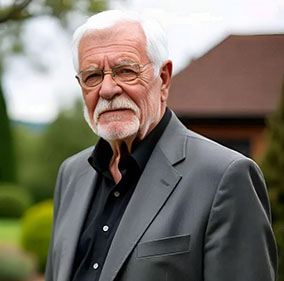

Acumeta is a cutting-edge technology-driven intelligent investment platform developed by Dr.Benjamin Ashford of the Algo Sensey Quantitative Think Tank Center, which seamlessly combines blockchain technology and quantitative systems, and introduces a universal token as a bridge. By seamlessly combining blockchain technology with a quantitative system and introducing universal tokens as a bridge, Algo Sensey Acumeta not only realizes intelligent investment strategies, but also builds a community ecosystem that interacts harmoniously with users in the long term.